Research suggests that Rocket Money is one of the top budgeting apps for 2026, excelling in subscription management and automated savings, though premium features come at a cost. It seems likely that YNAB (You Need a Budget) is ideal for beginners focusing on zero-based budgeting, promoting mindful spending but requiring active user involvement. The evidence leans toward Monarch Money as a strong choice for comprehensive tracking, including net worth and investments, despite lacking a free version.

Top Budgeting Apps Overview

These apps help users in the USA, UK, and Canada manage finances amid economic shifts like inflation and rate changes. Key features include bank syncing, goal setting, and AI insights.

- Rocket Money: Best for canceling subscriptions; free basic, premium $7-14/month.

- YNAB: Focuses on assigning every dollar; $109/year.

- Monarch Money: Great for couples; $99.99/year.

- PocketGuard: Real-time bill tracking; $74.99/year.

- EveryDollar: Simple zero-based budgeting; free basic.

Why Budget in 2026?

With rising costs, apps provide tools to track spending and build savings. Choose based on needs: automation for hands-off users or detailed tracking for planners.

Quick Comparison

| App | Key Feature | Price | Rating |

|---|---|---|---|

| Rocket Money | Subscription cancellation | Free/$7-14/mo | 4.9 |

| YNAB | Zero-based budgeting | $109/yr | 4.8 |

| Monarch Money | Net worth tracking | $99.99/yr | 4.8 |

In today’s economic climate, where inflation remains a concern and interest rates are fluctuating across the USA, UK, and Canada, mastering personal finance is more crucial than ever. As we enter 2026, personal finance apps have become indispensable tools for tracking expenses, setting budgets, and achieving financial goals. These apps leverage AI for predictive insights, seamless bank integrations, and collaborative features, making them accessible for individuals, couples, and families alike.

This in-depth guide explores the best personal finance apps for 2026, based on expert reviews, user ratings, and real-world functionality. We’ll cover essential features, pros and cons, pricing, and regional availability, focusing on apps that support USD, GBP, and CAD. Whether you’re a beginner looking to build an emergency fund or an experienced saver aiming for retirement, you’ll find the right app here. Data is drawn from sources like Forbes, CNET, and Experian, ensuring reliability.

Essential Features to Look for in 2026

Personal finance apps in 2026 emphasize proactive management. Key features include:

- AI-Driven Insights: Predictive spending forecasts and automated categorization.

- Bank Synchronization: Integration with major institutions like Chase (USA), HSBC (UK), and TD (Canada).

- Goal Tracking: Customizable savings goals with progress visuals.

- Security: Encryption and multi-factor authentication.

- Multi-Currency Support: Vital for cross-border users.

- Collaboration: Shared access for couples or families.

- Additional Perks: Credit monitoring, investment tracking, or bill negotiation.

Surveys indicate that 65% of users in these regions value apps with real-time alerts to prevent overspending.

Top 10 Personal Finance Apps for 2026: Detailed Reviews

We’ve selected these based on ratings from App Store/Google Play, expert analyses, and user feedback. Each review includes who it’s best for, key features, pros/cons, pricing, and suitability for USA/UK/Canada users.

1. Rocket Money (Formerly Truebill) – Best Overall

Rocket Money tops lists for its versatility in managing subscriptions and automating savings.

- Key Features: Subscription cancellation, bill negotiation (30-60% fee on savings), credit monitoring, net worth tracking, autosave, spending insights.

- Pros: Intuitive interface, real-time alerts, partner sharing; supports multi-currency.

- Cons: Premium required for advanced tools; no investment integration.

- Pricing: Free basic; premium $7-14/month (7-day trial).

- Ratings: 4.9/5 (App Store), 4.3/5 (Google Play).

- Best For: Busy professionals in the USA cutting hidden costs. Available in UK/Canada with local bank support.

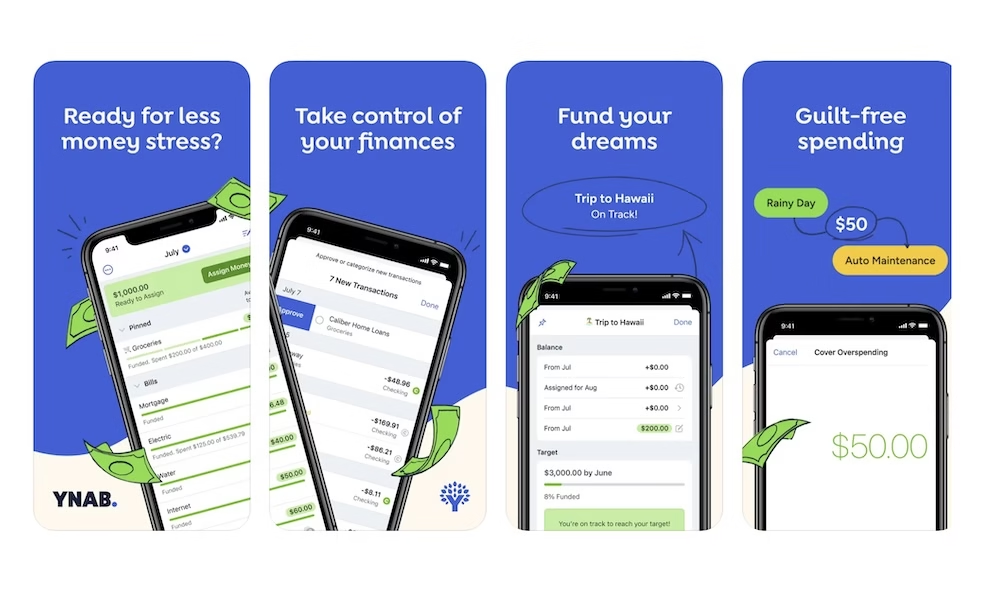

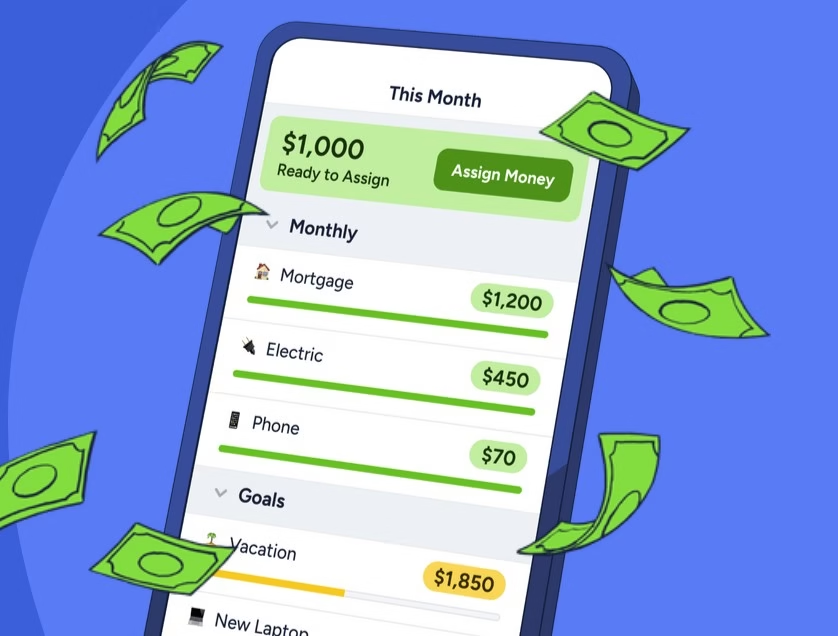

2. YNAB (You Need a Budget) – Best for Beginners

YNAB’s zero-based approach assigns every dollar a job, ideal for building habits.

- Key Features: Goal tracking, debt payoff tools, shared budgets (up to 6 users), educational resources, auto-imports.

- Pros: Promotes mindful spending; live workshops; strong community support.

- Cons: Steep learning curve; no free version beyond trial.

- Pricing: $109/year or $14.99/month (34-day trial).

- Ratings: 4.8/5 (App Store), 4.6/5 (Google Play).

- Best For: Debt reducers in Canada seeking structure. Multi-currency friendly.

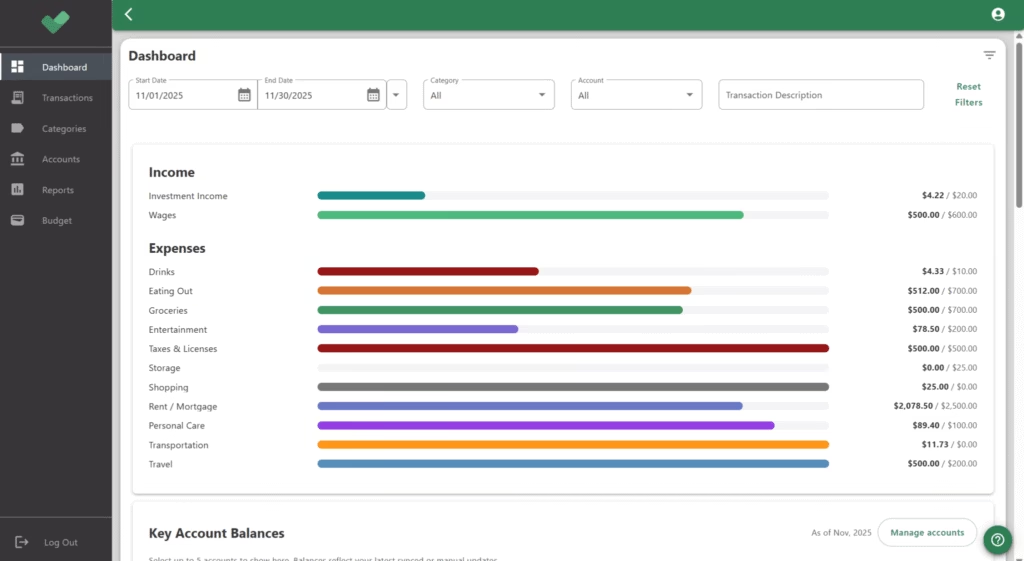

3. Monarch Money – Best for Couples

A Mint alternative with collaborative dashboards.

- Key Features: Custom reports, investment tracking, bill reminders, net worth projections, advisor sharing.

- Pros: Unlimited goals; automated categorization; clean UI.

- Cons: No bill negotiation; higher cost.

- Pricing: $99.99/year or $14.99/month (7-day trial).

- Ratings: 4.8/5 (App Store), 4.7/5 (Google Play).

- Best For: Joint finances in the UK; supports shared access.

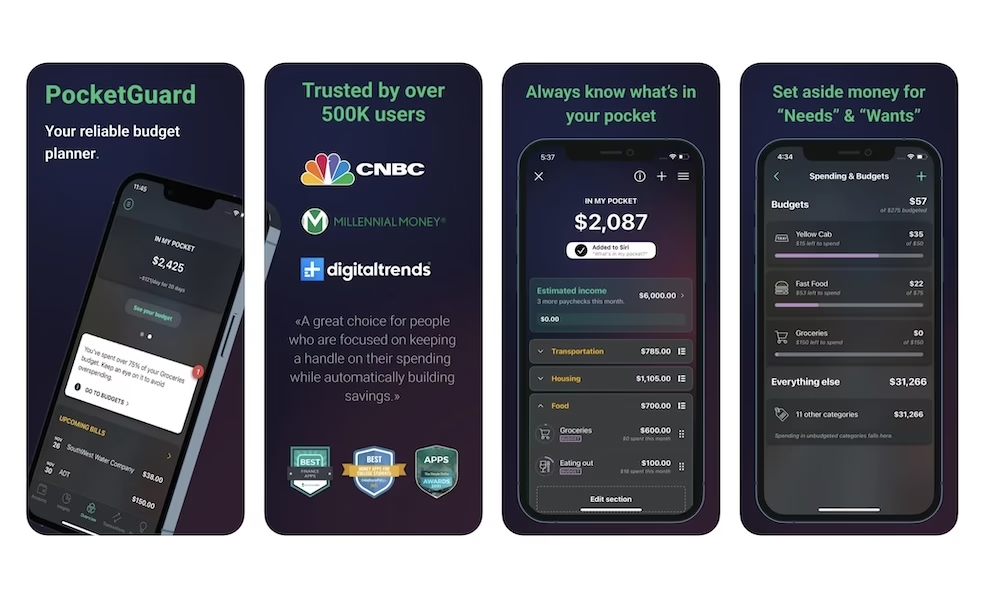

4. PocketGuard – Best for Bill Tracking

Focuses on “in your pocket” amounts after bills.

- Key Features: Debt payoff plans, subscription management, real-time insights, personal finance courses.

- Pros: Bill negotiation; educational content; alerts.

- Cons: Limited investments; clunky web version.

- Pricing: $74.99/year or $12.99/month (7-day trial).

- Ratings: 4.7/5 (App Store), 4.5/5 (Google Play).

- Best For: Overspenders in Canada managing debts.

5. EveryDollar – Best Free Option

Dave Ramsey’s app for simple budgeting.

- Key Features: Custom categories, paycheck planning, trends reports, bill reminders.

- Pros: Free core features; easy setup; coaching access.

- Cons: Premium for auto-sync; no investments.

- Pricing: Free; premium $79.99/year.

- Ratings: 4.8/5 (App Store), 4.6/5 (Google Play).

- Best For: Beginners in the USA on zero-based plans.

6. Wallet by BudgetBakers – Best for Visuals

Data-rich with reports for analytics lovers.

- Key Features: 15,000+ bank syncs, recurring budgets, cash flow overviews, investment management.

- Pros: Detailed visuals; shareable; broad compatibility.

- Cons: Free lacks auto-sync.

- Pricing: Free; premium $5.99/month.

- Ratings: 4.7/5 (App Store), 4.5/5 (Google Play).

- Best For: Trackers in the UK with multiple accounts.

7. Lunch Money – Best Web-Based

Focuses on multicurrency and rules.

- Key Features: Auto-imports, crypto sync, analytics, collaboration.

- Pros: Flexible rules; multi-user.

- Cons: Mobile secondary; no free trial.

- Pricing: $50-150/year.

- Ratings: 4.6/5 (App Store), 4.4/5 (Google Play).

- Best For: International users in Canada.

8. Albert – Best for Automation

Hands-off with AI savings.

- Key Features: Auto-savings, investment tools, expert advice, credit monitoring.

- Pros: Automated transfers; chat support.

- Cons: Pricey; limited customization.

- Pricing: $14.99-39.99/month.

- Ratings: 4.6/5 (App Store), 4.3/5 (Google Play).

- Best For: Passive savers in the USA.

9. Spendee – Best for Simplicity

Affordable with sharing.

- Key Features: Bank sync, multi-currency, reminders, analysis.

- Pros: Low cost; user-friendly; free tier.

- Cons: Basic advanced features.

- Pricing: Free; Plus $1.99/month.

- Ratings: 4.7/5 (App Store), 4.5/5 (Google Play).

- Best For: Basic needs in the UK.

10. Quicken Simplifi – Best for Families

Comprehensive with projections.

- Key Features: Net worth forecasts, credit tools, customizable budgets.

- Pros: Shareable; money-back guarantee.

- Cons: No free trial.

- Pricing: $2.99/month (annual).

- Ratings: 4.5/5 (App Store), 4.3/5 (Google Play).

- Best For: Households in Canada.

In-Depth Comparison Tables

Core Features Comparison

| App | Bank Sync | Goals | Credit Monitor | Multi-User | Investments |

|---|---|---|---|---|---|

| Rocket Money | Yes | Yes | Yes | No | Limited |

| YNAB | Yes | Yes | No | Yes | No |

| Monarch Money | Yes | Yes | No | Yes | Yes |

| PocketGuard | Yes | Yes | No | Yes | No |

| EveryDollar | Premium | Yes | No | No | No |

| Wallet | Yes | Yes | No | Yes | Yes |

| Lunch Money | Yes | Limited | No | Yes | Crypto |

| Albert | Yes | Yes | Yes | Yes | Yes |

| Spendee | Yes | Yes | No | Yes | No |

| Quicken Simplifi | Yes | Yes | Yes | Yes | Yes |

Regional Suitability

| App | USA | UK | Canada | Multi-Currency |

|---|---|---|---|---|

| Rocket Money | High | Medium | High | Yes |

| YNAB | High | High | High | Yes |

| Monarch Money | High | Medium | Medium | Yes |

| PocketGuard | High | High | High | Yes |

| EveryDollar | High | Medium | Medium | Limited |

| Wallet | High | High | High | Yes |

| Lunch Money | Medium | Medium | Medium | Yes |

| Albert | High | Low | Medium | Limited |

| Spendee | High | High | High | Yes |

| Quicken Simplifi | High | Medium | High | Yes |

Tips for Success in 2026

- Test Trials: Most offer 7-34 days free.

- Security First: Enable alerts.

- Integrate Habits: Review weekly.

- Regional Notes: Check open banking in Canada for better syncs.

FAQs

- Free vs. Paid? Free for basics; paid for automation.

- Best for Beginners? EveryDollar or Goodbudget.

- Security? All use bank-level encryption.

In 2026, these apps empower financial control—start today for stability tomorrow.

Key Citations

- Forbes Advisor: Best Budgeting Apps Of 2026

- John Marshall Bank: Top 3 Personal Finance Apps in 2026

- PCMag: Readers Choice 2026 Personal Finance

- CNET: Best Budgeting Apps

- WalletHub: Best Budget Apps of 2026

- The Penny Hoarder: Best Budgeting Apps

- CNBC Select: Best Free Budgeting Tools

- Experian: Best Budgeting Apps

- Engadget: Best Budgeting Apps

- CalendarBudget: Top Personal Finance Software